Are Flood Policies Necessary in Low-Risk Zones?

5/30/2019 (Permalink)

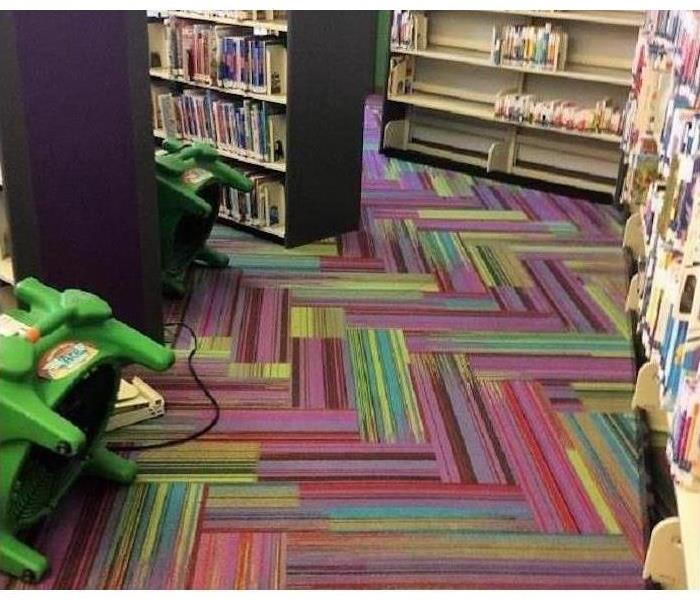

Flooding in Asheville, NC isn’t isolated to areas within flood zones. For instance, flooding may happen because of heavy spring thaws, uncommon accumulations of rain, and the rapid approach of extra storms after wildfires. It doesn’t take much water to do serious damage. Further complicating the issue of whether to own commercial insurance for flooding are common misconceptions about flood insurance.

Flood Policies

- A flood policy isn’t necessary if the business isn’t established in a flood plain.

- Floods and any type of flooding are covered by existing insurance policies.

- Flood policies are all the same and all-inclusive.

- Natural disasters are the only cause of flooding.

Misconceptions To Clear Up

Another serious misconception in Asheville, NC is that low-risk flood zones are essentially no-risk zones. Unfortunately, flood maps change as environmental factors change. A commercial property may be outside of a flood zone one year and within a high-risk flood zone within a year. This means that even businesses built on properties outside of flood plains should have a commercial insurance policy for flooding as recommended by FEMA. That policy should be suited to the specific needs of the business and its environment. The policy should also be written to include flooding that takes place due to burst pipes, sprinklers triggered by fire alarms, fast-melting snow, and other emergencies not triggered by a natural disaster.

The Truth About Flooding and Insurance

The truth is that there are different types of policies to cover commercial properties, homes, repair costs, business inventory, and relocation costs. If a business’ insurance company doesn’t require flood insurance, business owners may still want to consider the value of an insurance policy specifically for flooding and water damage. According to FEMA, one inch of water can cost a business tens of thousands of dollars beyond the cost of clean-up services. The annual cost for adequate flood insurance is much, much less than that. When considering whether to purchase a flood policy, business owners should carefully weigh their potential losses against the investment in commercial insurance.

24/7 Emergency Service

24/7 Emergency Service